In Australia, the inflation target and cash rate are both managed by the Reserve Bank of Australia (RBA), making the relationship between the two very close. The cash rate is used to restrain or energise economic activity to ensure that inflation is consistent with the target of 2-3%. If inflation is higher than this target for a long period of time, the RBA is more inclined to raise the case rate.

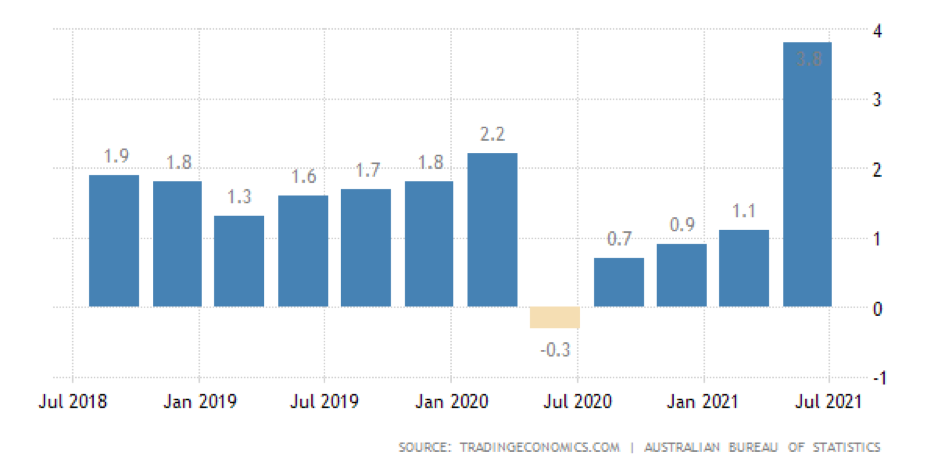

Over the past 3 years the inflation rate has been under the target of 2-3%, and this aligns with the cash rate and home loan market also seeing decreases and reaching record low interest rates in 2021. Despite inflation jumping to its highest level since Q3 2008 in June 2021, as the economy is still recovering from the impacts of COVID-19, the cash rate is expected to remain low, as a means to continue to stimulate the economy.

source: https://tradingeconomics.com/australia/inflation-cpi

How does inflation affect interest rates?

Inflation can affect home loan interest rates as the RBA cash rate is used to determine the rate at which lenders pay to borrow funds from other lending institutions. Therefore, if the RBA increases or decreases the cash rate to align Australia’s inflation rate with its target, it is likely to have an influence on your home loan interest rate.

If you have owned your property for a few years, it may be time to review your home loan to make the most out of the current inflation and interest rate situation and find out if you’re receiving the best deal. You can speak to your local Mortgage Choice broker who can go through your situation and ensure you have the right loan for you.

Fixed vs variable home loans

Understanding how inflation and interest rates influence each other is useful in determining whether your mortgage should be fixed or variable.

If you choose to have a variable home loan your interest rates are likely to be affected by inflation as variable interest rates fluctuate with the cash rate. This means you can benefit if the RBA or your lender drops interest rates, or if rates rise, your home loan interest rate may rise.

If you choose to get a fixed rate home loan, you will not need to think about the cash rate or inflation impacting your home loan as your interest rate and repayments will be set for the specified period you choose to fix.

Should you get a fixed or variable home loan?

With the current inflation and interest rate situation, deciding whether you should get a fixed or variable home loan can be a difficult decision. Currently, interest rates are at record lows and this can be a tempting incentive to fix your home loan at these rates for this period of time. Although if interest rates were to reduce further you would not see any of the benefits of this drop.

It is of course important to understand that there are many pros and cons of both fixed and variable home loans outside of just the interest rate alone. Speaking to a Mortgage Choice broker will help you understand the differences between fixed vs variable and identify which home loan would be right for your situation.

Is it time to refinance?

It can be difficult to know where to start with reviewing your current loan and how to find if there’s something better out there for you.

Refinancing your loan involves taking out a new loan to pay out your existing and can be done for many different reasons:

- Securing a better interest rate

- Access home equity

- Consolidate debt

- For better home loan features

With the lowest rates ever in the market, now is a great time to assess your home loan to ensure it’s the right one for you.