Volatility in the market causes anxiety. Whether you’re a first-timer or an experienced investor, even the thought of losing money in the market can make you feel sick. As an amateur investor or, as named by Maureen (Jordan), “the accidental investor” (and republished in Peter Switzer’s book Join the Rich Club), I’d like to share how I manage my anxiety when investing in the stock market.

I am lucky to learn from Peter (Switzer) and his guests while filming behind the camera, but my psychology degree has also come in handy to help me understand how my brain works under stress and anxiety, especially when I first started investing.

While a plethora of information exists on investing in the stock market, little has been said about the psychology behind it, especially the decision-making process in our brain that can sometimes lead us investors in the wrong direction. Warren Buffett once said, “Success in investing doesn’t correlate with IQ, once you’re above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.” In my opinion, what he’s trying to say here is that successful investing involves something far more important than superior brain power – temperament, the ability to remain calm and rational in the face of uncertainty.

Anxiety arises when we encounter challenges in our lives. People dealing with anxiety are often faced with different types of cognitive distortions. These include black and white thinking (i.e. believing that situations can only be either absolutely perfect or disastrous); over-generalising (i.e. thinking one unpleasant experience is bound to reoccur in the future); personalising (i.e. attributing problems to oneself, self-blaming); and jumping to negative conclusions.

Many of us believe that negative events cause us to act in certain ways. Research, however, tells us that our reactions are largely based on our thoughts and interpretation about the adversity. When adversity happens, the first thing we try to do is explain to ourselves why it happened. Our beliefs about the cause of the adversity set off our reaction – how we feel and what we do.

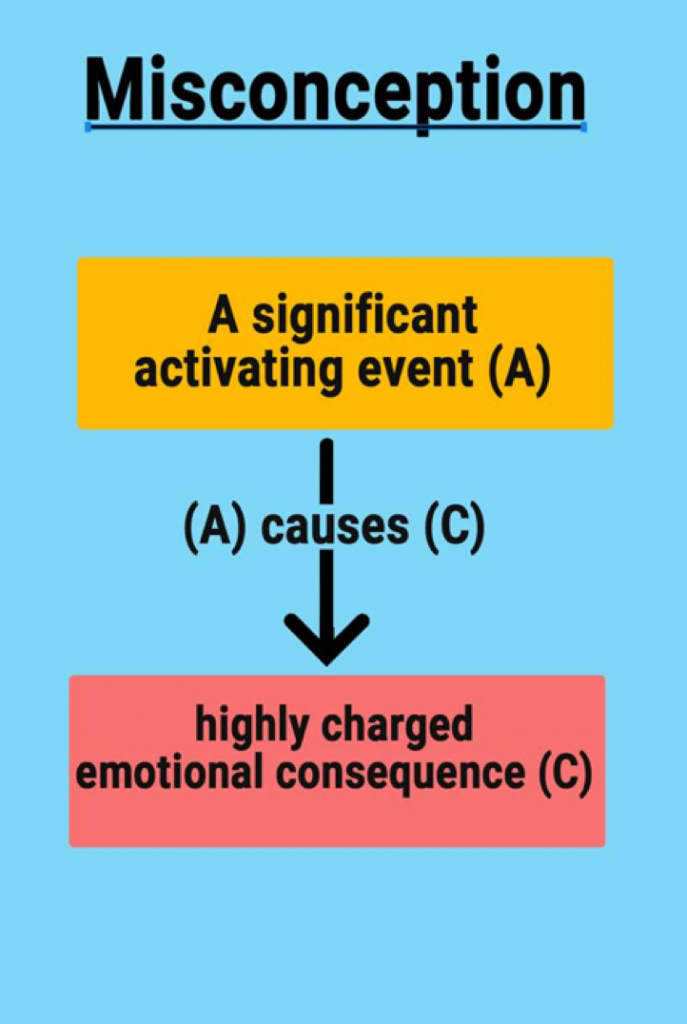

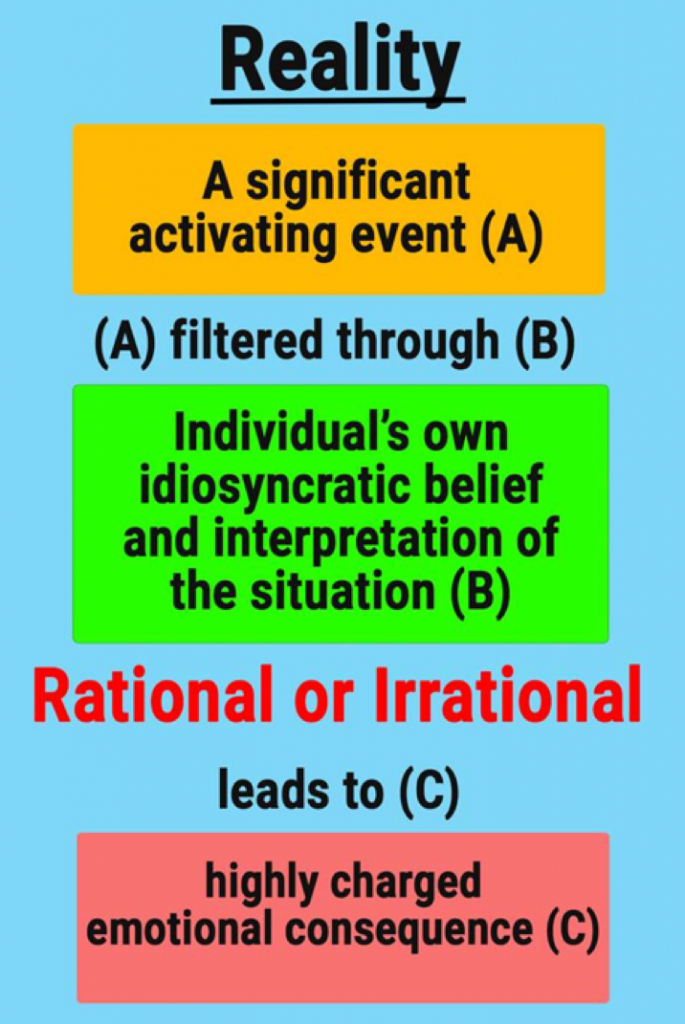

A renowned American psychologist, Dr. Albert Ellis, pioneer of the ABC model, explains that when a highly charged emotional consequence (C) follows a significant activating event (A), it may appear that A causes C. In actuality, however, emotional consequences are primarily created by the individual’s own idiosyncratic belief and interpretation of the situation (B). Thus, (A), filtered through (B), leads to (C).

A = Adversity (significant activating event)

B = Belief (individual’s own idiosyncratic belief and interpretation of the situation)

C = Consequence (highly charged emotional consequence)

Here’s an example (irrational thinking):

I have done my due diligence for months and finally decided on investing in the stock market. Shortly after I made the purchase, the share price of that stock went down. I think to himself, “I am bad at investing, I will keep losing money, why did I even start investing, I should have just kept all my money in the bank.”

In this scenario,

A = Share price went down after purchase

B = I am terrible at investing and I will lose all my money

C = Feeling of disappointment and confusion. Loses motivation to stay in the market. Sell shares as soon as it falls to avoid any future losses

The highly charged emotional consequence, such as disappointment and confusion, has led to an irrational belief that I must have done something wrong and will end up losing all my money, avoiding all types of investment at all in the future.

Same example (rational thinking):

Share price went down shortly after I’ve made the purchase but I think to myself, “Well, that is a bit disappointing. But I actually just started investing and from what I have researched, stock prices are driven by a variety of fundamental factors (e.g. overall state of the economy, factors including interest rates, production, earnings, employment, GDP, etc). Market volatility is a normal part of investing and many of the large daily price declines are at least partially offset by similar price increases. My goal is to focus on a long-term perspective to achieve success in investing. I will keep gathering information and take action as needed (e.g. set a stop-loss order to minimise my loss and move on to another stock or ETF) or leave it and ride the market if my analysis does not call for a change.”

A = Same scenario as above

B = Stock prices are driven by a variety of fundamental factors and market cycle

C = No emotional distress; decide on best course of action (set stop-loss order or continue to hold)

A = remains the same, but my belief (B) is different. Thinking that my loss is due to normal daily fluctuations and the fundamental nature of the market allows myself to let go of initial feelings of disappointment and confusion. The (C) rational responses would result in no emotional distress but rather generate positive and reasonable thoughts and then decide on the best course of action.

Overcoming emotions is the hardest but greatest skill an investor needs to master. It is very common to lose faith when stocks are down and you feel you are “losing money”. However, bear in mind that those losses are only paper losses until the moment they are sold.

I am still learning to make every attempt to get thinking out of my emotional responses centres in my brain and into my frontal lobes, where reason and logic pertain. Next time when you are sweating over the market swings, think about the ABC model. I hope it helps to stop you from making an emotion-driven mistake and helps ease your anxiety. We all know certainty doesn’t exist in the financial market but we also need to keep in mind that after every bear market comes a bull market. So, let’s keep calm and ride on!