When business commentator Peter Switzer was asked by a listener on Radio 2GB last week what someone should do if they knew that their money life was in chaos but wanted to change all that to become a millionaire, this was his response: “It’s a big task to change anyone but to go from chaos (where the chance of building wealth is minimised) to the establishing of order and getting the snowball of wealth rolling, is doable. And yes, you should end up a millionaire!”.

But Peter said that there has to be a ‘commitment’ to a new way of living. “That’s right — if you live in chaos, you have to live orderly to change that and by following processes, the end result will be success,” he said.

Switzer is well-known for the saying “You don’t get richer in a day but daily”. And he shows those financial planning clients who need to restore order in their life, just what a getting-your-act together plan (for day-by day-improvements) looks like.

“These are the questions we ask our younger (or sometimes even the more mature ones who’ve lived it up for too long!) financial planning clients:

- What are your money goals? (Write or type them down.)

- Are you on track to make them happen? (Yes, no or don’t know!)

- What are you prepared to do to make them happen? (Follow your advice!),” Peter advised.

And then Peter outlined what his advice often ends up being:

- Let’s do a budget to see where you earn and spend your money. (Can we increase the income? And/or cut your costs?)

- This is what you should be able to save and we will do this to build up an amount of money that will be invested to grow your wealth.

- Here are the investments that the normal person does not access and it’s why they don’t end up with abnormal amounts of wealth.

- Are you paying too much tax? And can the Tax Office help you to invest in wealth-building assets?

What are the investments that Switzer suggests?

- Add more to super via salary sacrifice, which allows you to get a maximum $25,000 a year into super. With salary sacrifice, if your boss puts $7,000 out of your annual wage into super for you, you can salary sacrifice extra money out of your pay up to $25,000 and add to your super. In this case, the person could add in $18,000! And wages that could be taxed at 19%, 32.5%, 37% or 45% would only get taxed at 15%, before ending up in super, so you get more into super, which will help you get rich!

- Make sure you are in the best performing super fund that does not overcharge you. Yahoo’s search engine will help you find out the best super funds.

- Should you set up a self-managed super fund? This depends on age, how big your super balance is and whether you want to run your own super.

- Exchange traded funds mean you can invest in the stock market very easily nowadays and so you can, for example, invest in Australia’s top 200 companies in virtually one ‘stock’, called an ETF, which you can buy into with online stockbrokers.

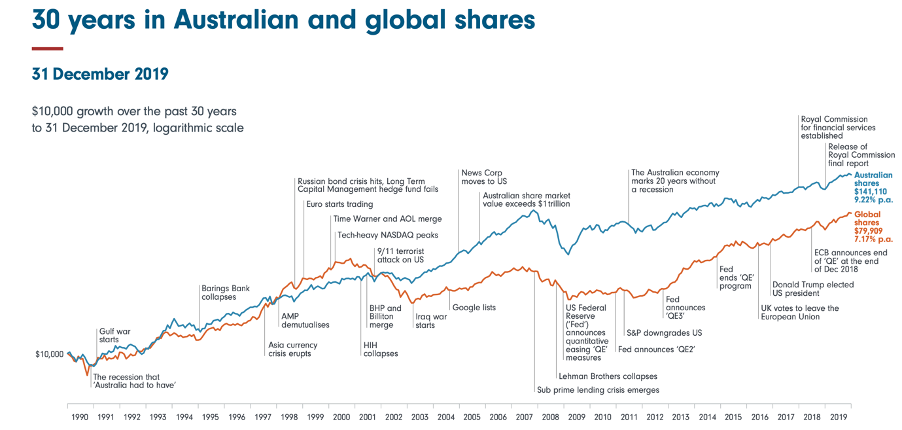

This chart shows you how the S&P/ASX 200 Index has grown over time and an ETF that tracks this Index can help you grow your wealth.

There you have it! People who end up being ‘rich’ and financially independent are people who replace chaos with organisation and frivolous spending with sensibly learning about quality investments. And that’s what we want to help you with here at Tilly Money!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.