Superannuation is a ‘forced’ way of saving for your retirement and was introduced as compulsory in 1991 by our then Prime Minister, Paul Keating.

When you start your first job, your employer will ask you to pick a super fund. If you don’t they will put your super into a nominated fund. A lot of young people end up in industry super funds as their first jobs are usually retail or hospitality.

Once you have chosen your fund, your employer contributes at least 9.5% of your wage into that fund. You can make your own contributions up to a legally defined amount as well; in fact, it’s highly recommended that you do.

Every time you start a new job, make sure your new employer has the details of your super fund. This avoids them opening another account in your name, which means you’ll be charged multiple admin fees.

Your super fund then invests that money in a variety of ways. Your money could be invested in such assets as Australian or overseas shares, property, bonds or cash.

The three key strategies for investing, are:

- Growth.

- Balanced.

- Conservative.

As a default, most people are in a balanced option, however you have the ability to change this. You should choose the option that best fits what’s called your risk profile. Your risk profile considers these things.

- Your age.

- How comfortable you are with investment risk.

- How long it will be before you can access your funds.

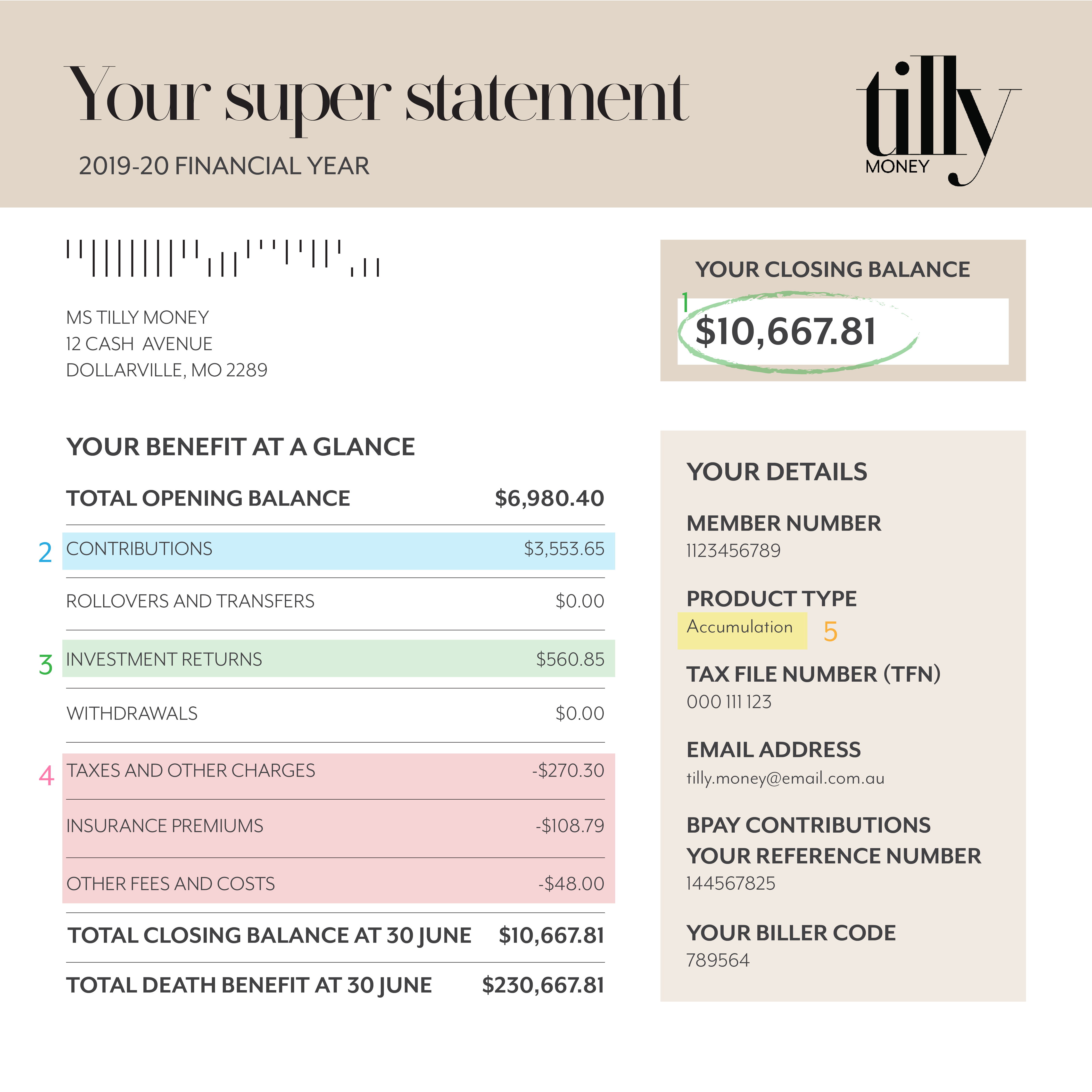

Checking out your super statement

Below is a guide on how to read a superannuation statement. You should receive a statement from your fund at least once a year. Make sure you take the time to read and understand your statement, as you may need to make changes to your investment option or even swap to a new super fund, if your current fund isn’t performing.

Have a look at this guide that has been coloured and numbered to show you what’s important to look at. The numbers on the guide are then defined below.

1.YOUR CURRENT BALANCE: This is how much money is in your super fund. Are you happy with your balance? How do you know how your contributions are tracking? You can use an online calculator to see how much you’ll retire with on your current trajectory.

2. CONTRIBUTIONS: Your employer should be contributing 9.5% of your pay into super. You can check that you’re receiving the right amount here. Any extra contributions that you make will also be added to this number. You may also receive an extra contribution from the government listed as a low income superannuation tax offset.

3. RETURNS: This is where you will see what the returns on your contributions have been for the period of time that the statement covers. The returns come from the investments that your fund makes on your behalf.

4. DEDUCTIONS: Here you will see taxes and fees being taken out. You may also be charged for life insurance premiums. You can opt out of insurance. There should be a more detailed breakdown later in your statement.

5. PRODUCT TYPE: There are two types of super funds; defined benefit funds and accumulation funds. Most super funds are accumulation funds because people are still working and accumulating super into their fund. An accumulation fund is when the money that you and your employer put in, is then invested by the fund and accumulates over time.

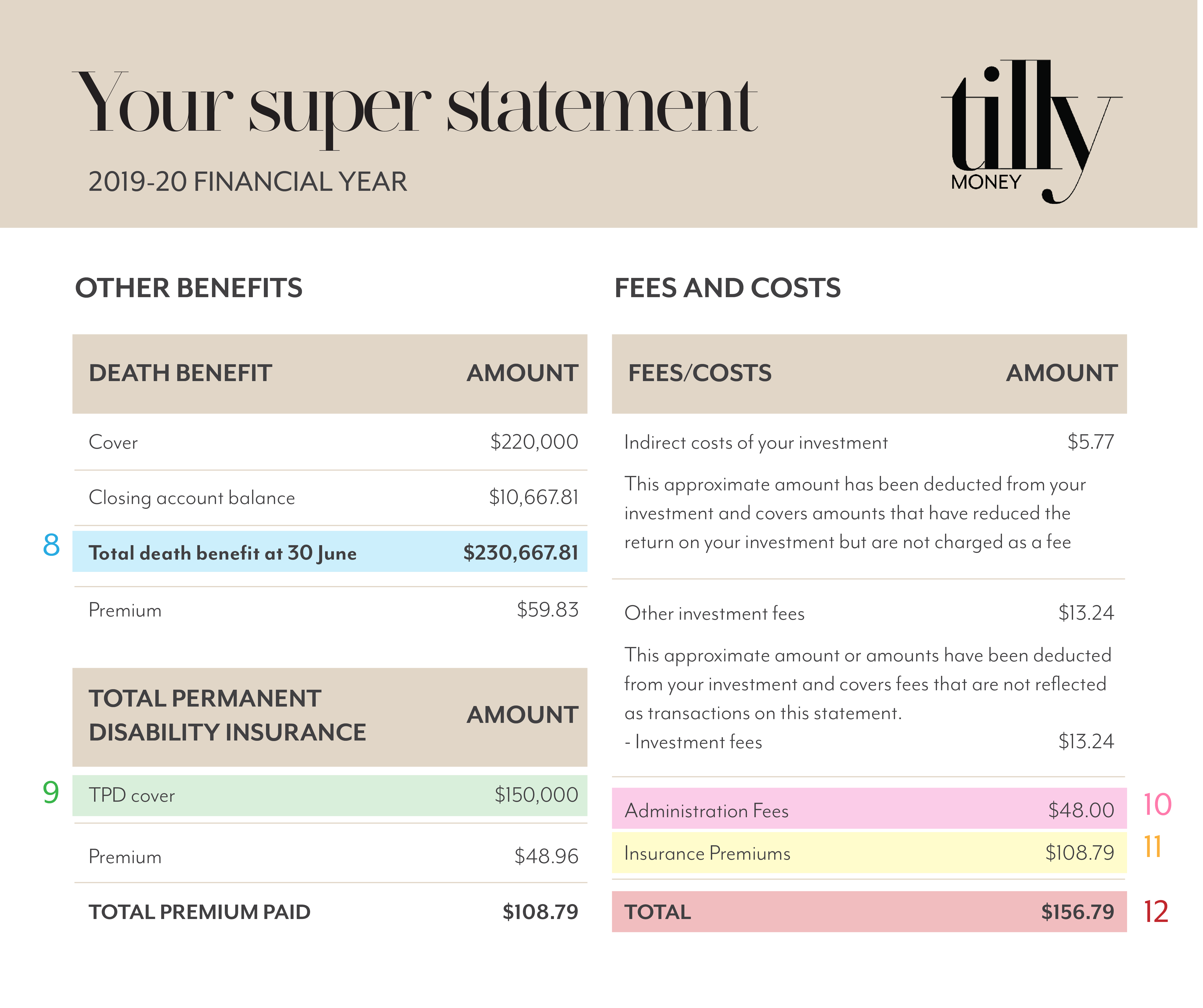

6. INVESTMENT OPTION: Your statement will tell you what investment option or strategy is used to invest your money. As mentioned earlier in this article, the three main ones are; conservative, balanced and growth. Your strategy should match your risk profile. Usually the default option is a balanced option. You can change this depending on your circumstances. You should also be able to see the returns of your option (and other options) over various time periods. Use a comparison site to see if your returns are the best they can be.

7. ASSET ALLOCATION: You will also be able to see how your money is spread across different asset classes. You can do further research to find out exactly which Australian shares or infrastructure your super fund invests in and check that they align with your values e.g. you may want to be in companies that have a strong social and environmental culture.

8. TOTAL DEATH BENEFIT: A death benefit (otherwise known as Life insurance) pays a lump sum or income stream to your beneficiaries when you die or if you have a terminal illness. The total death benefit listed on your statement is the amount you are covered for (you can opt to change this amount) plus your closing superannuation balance. You pay a premium out of your fund to have this insurance and any other insurance.

9. TPD COVER: TPD insurance pays a lump sum if you become totally and permanently disabled because of illness or injury. It is up to you whether you want or need TPD insurance. Most super funds offer default TPD cover that’s cheaper than buying it directly.

10. ADMIN FEES: This is the fee for administering your account. This fee is usually a percentage of your balance and may be capped at a certain amount. You can use comparison sites such as Super Ratings to compare what you’re paying in fees to the top 10 superfunds with the lowest fees.

11. INSURANCE PREMIUMS: The amount deducted from your account to pay for your insurance cover. It’s a good idea to review what type and level of insurance you need as your circumstances may change over time.

12. This is the total amount that has been taken out of your account. Along with the fees and insurance premium deductions, you will also be charged tax on your contributions, which comes out as a separate cost to fees and insurance premiums.