It’s currently tax time and one useful piece of information you can take from reading this is to get your tax return done before 31 October 2020! Whether you lodge your tax through an accountant, do it yourself via MyGov, getting a tax refund or paying a hefty amount of tax, there’s one constant throughout the tax process that applies to everyone no matter their income level – somewhere along the process you’re going to have questions.

Lodging a tax return is different for everyone, so certain parts of this article may or may not apply to you. Let’s figure out our first step…

Do I need an accountant?

There’s obviously no straight answer to this because everyone’s circumstances are different, but going to an accountant is highly recommended if you find the whole subject of tax overwhelming or have income from a few different places.

As a rule of thumb, if you don’t have any investments or additional income aside from your wages and the interest from your bank account (which the Australian Tax Office or ATO already fills in – seriously how do they know EVERYTHING?) you probably don’t need to go to an accountant at this stage.

But when you do start getting serious about your finances (which most of you will be if you’re reading this) and you’re growing your wealth in a number of different places, then speaking with an accountant or tax agent can help you make sure everything is on track.

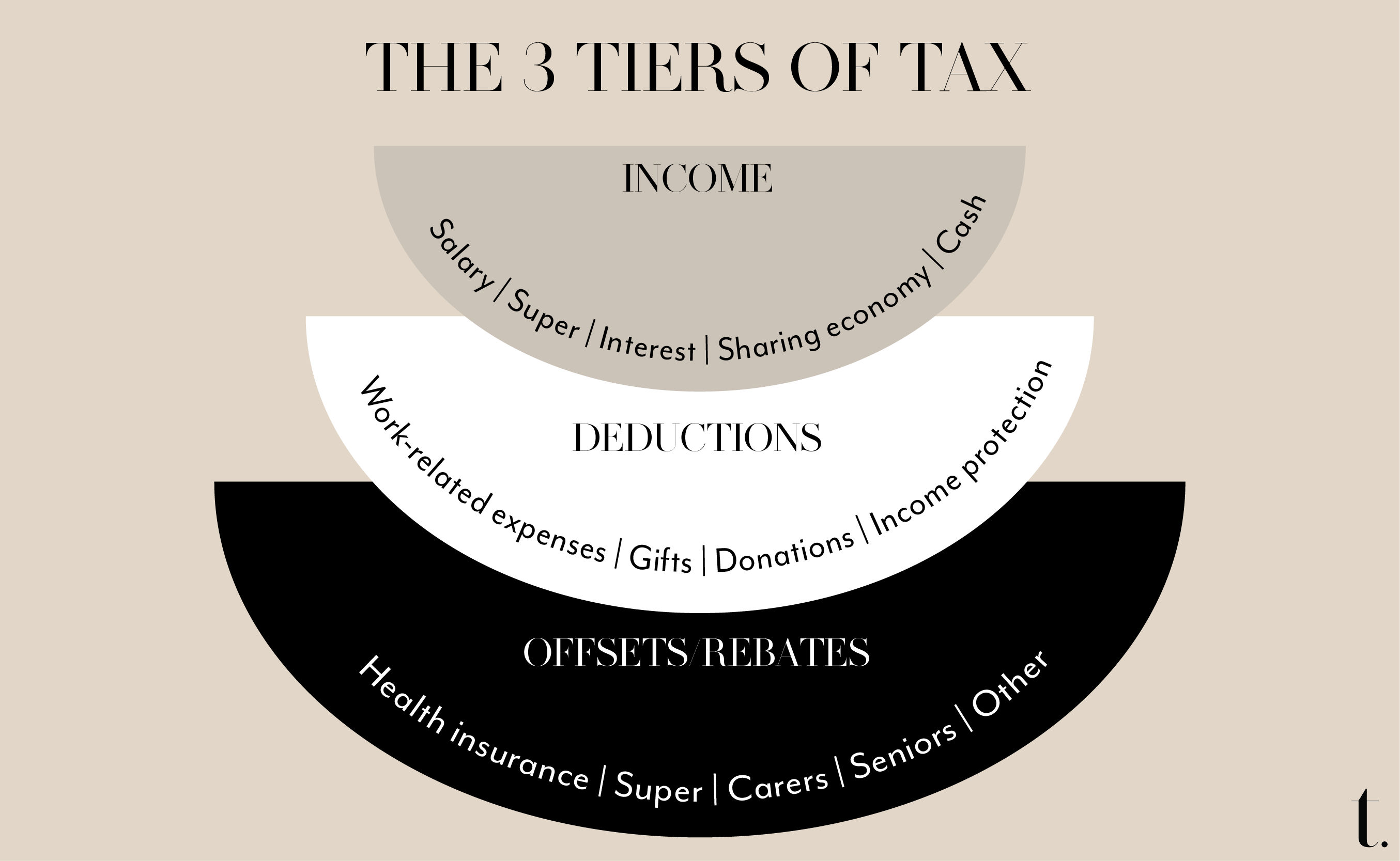

There are three areas you need to be aware of when it comes to lodging your taxes, whether you’re doing it through an accountant or doing it yourself:

- Income (mostly pre-filled by the ATO)

- Deductions (this is what you need to be on top of to reduce your tax!)

- Offsets and Rebates (what you can get back due to things like Medicare and health insurance).

Income

Income is basically any money you have coming in, and it can be much more complex than just your wages.

Luckily, the ATO is pretty efficient, so your income is mostly pre-filled by the ATO. However, these are things you need to be aware of:

a) Salary, wages or other income on an income statement/payment summary, Australian Government payments (JobSeeker, Newstart etc.) or First home super saver (FHSS) scheme payment.

The ATO pretty much sorts this all out for you (many thanks!) so all you need to do is access your income statement via MyGov. Your accountant can also do this for you.

Something worth being aware of when lodging your tax this financial year is the introduction of “Single Touch Payroll” in July 2019. What this means for you is that you would have no longer received an annual payment summary or end-of-year payment summary from your employer in your emails. You will however be able to view your income statement in the ATO section of my.gov.au or your accountant can access it for you.

Here’s how to access your income statement online:

- Log into MyGov and your ATO account should be linked. If not, you can link it by “linking services” and selecting Australian Taxation Office.

- Click ATO.

- Under ‘For Action’ click ‘View my Income Statements’.

- It should have your employer(s) details already there with your financial year income and tax.

- Beside your employer(s) name, it should have either green text saying “tax ready” or red text saying “not tax ready”. This is what it should look like:

- If it says tax ready, you can go ahead and start lodging your tax return.

- If it says not tax ready, you’ll need to speak with your employer and finalise your taxes before starting to lodge your tax return, as the figures could change and you may have to redo your tax return (annoying).

If you received JobKeeper, this is treated as wage income by your employer, so you will receive an income statement from your employer as you normally would.

b) Income taken from your superannuation

This section is mostly applicable for retirees and those who gain income from their superannuation or pensions.

But if you accessed your superannuation early due to COVID-19, this section is relevant to you also. For more information visit the ATO guide.

c) Interest earned or other Australian income

This includes:

- Interest (that you earn, which is predominantly interest from your bank account and is usually pre-filled by the ATO).

- Dividends (what you get paid by companies that you buy shares in).

- Rent (paid to you by a property you own).

- Capital gains or losses that are not from a managed fund (for more information visit the ATO guide).

d) Sharing economy

The introduction of apps and new technology has meant we are getting income from a few different places nowadays, and the ATO is all over it!

Income that counts in the sharing economy includes income from app-services like Uber and AirBnb.

Income from things like cryptocurrency don’t count in the sharing economy but still need to be declared for tax purposes.

You can find out more here.

e) Cash income

Even if you’re paid in cash, this still needs to be declared to the ATO.

The ATO provides a detailed explanation of lodging your cash income tax here.

After your income is all sorted, you’ll need to move on to tax deductions.

Deductions

As the name suggests, tax deductions are a way for you to pay less tax (legally) because you can claim some of your costs over the year as work expenses. As the late media mogul Kerry Packer once said:

“I’m not evading my tax in any way, shape or form. Of course, I’m minisiming my tax. If anybody in this country doesn’t minimise their tax, they want their head read. As a government I can tell you that you’re not spending it that well that we should be paying extra tax.”

The ATO organises tax deductions into:

a) Work-related expenses

This is subjective to each industry and the ATO (bless their efficiency) have specific guides for each industry that explains what you can and can’t claim depending on your occupation. You can access the full guide here.

You will need to have an income statement and provide proof of purchases.

COVID-19 has also trapped us all at home, so there are a few extra things you may be able to claim as a deduction (don’t be alarmed – we’ll explain this later on!).

You can read about additional work from home tax deductions here.

b) Gifts, donations and other costs

If you made a donation (to a charity), this is tax deductible. You can access the full list of what you can and can’t claim as a deductible gift receipt (DGR) here.

If you have a savings or investment account gaining interest, you can claim the fees or bank charges related to this account. Or if you’ve borrowed money to buy shares you can also claim the interest charged on these borrowings as a deduction. Access the full list of what you can and can’t claim as interest, dividends or other investment income deductions here.

c) Other deductions

If you’re a student who is also working, you’re also entitled to certain tax deductions (under certain conditions) and the entire list of what you can and can’t claim can be accessed here.

Side note: if you want to see how your HECS or HELP debt is going, visit my.gov.au > ATO > Tax > Accounts > Loan accounts. For more information about study loan repayments and thresholds click here.

Offsets and rebates

The terms “tax offset”, “tax rebate” and “tax credit” are pretty similar. They all reduce the “amount of tax payable on your taxable income” that is directly subtracted from the tax you have to pay.

The most important distinction is to understand how these are different from tax deductions. Tax deductions are subtracted from your INCOME and then your tax is determined based on that (to allow you to reduce the amount of tax you have to pay – legally). Meanwhile, tax offsets or rebates are directly subtracted from your TAX.

Tax offsets and rebates have a range of purposes. They can be used to encourage certain activities, for example, the Private Health Insurance Rebate that encourages Australians to take out private health insurance.

You can see if you’re eligible for a private health insurance rebate here.

Something to note is that from 1 July 2019, health insurers are no longer required to automatically send you your private health insurance statement. Your private health insurance statement information is often pre-filled by the ATO when filling out your claim, but if this is not the case you will be required to contact your insurer and request your private health insurance statement. You can read more about this here.

Medicare Levy Surcharge

This is also a good time to bring up the Medicare Levy Surcharge (MLS), which is an additional charge for taxpayers who don’t have the appropriate level of private patient hospital cover, while earning above a certain income. This surcharge aims to encourage people to take out private patient hospital cover. Find out more about the Medicare Levy Surcharge figures here.

Lifetime Health Cover

There’s also another thing to note when it comes to your health insurance cover and that is the Lifetime Health Cover (LHC) government initiative, which acts as an incentive for Australians to purchase private patient hospital cover earlier in life. If you do not have private patient hospital cover before you turn 31, you will pay a 2% LHC on top of your premium each year. Read more about LHC here.

We know there’s even more to these deductions and rebates etc. but use this as a guide to become aware of certain terms in the world of tax and to access this tax information going forward. The three things you need to remember and become familiar with are:

-

Your income

-

Your tax deductions; and

-

Your tax offsets.

If you’ve decided you want to go ahead and lodge your tax return yourself, here’s a step-by-step guide on how to lodge your return through MyGov:

Lodging your tax return yourself via MyGov

- Log into MyGov and your ATO account should be linked. If not, you can link it by “linking services” and selecting Australian Taxation Office. Click ATO.

- Go to Tax > Lodgements > Income tax

- Fill out your personal details.

- Were you an Australian resident for tax purposes from 2019 to 2020? If you had a job and had tax come out of your payslip between those dates then yes you were an Australian resident for tax purposes from 2019 to 2020?

- After you’ve filled out these steps, you’ll notice you’re up to the “Income” section previously explained at the top of this article.

- Once you’ve filled out the INCOME section (most of which is usually prefilled, depending on your circumstances), you’ll move on to the DEDUCTIONS section.

- If you have deductions to claim, you would have to organise this before lodging your tax return. You still have a while to lodge your tax (31 October 2020, remember!), so maybe start thinking what you could claim as a deduction, write it down, find your proof of purchase and (if you want to really be on top of things) chat to an accountant to help guide you through any additional things you could deduct.

- After the deductions step, you’ll be up to OFFSETS AND REBATES.

- After filling out your insurance details, the ATO calculator will automatically judge whether you are entitled to a rebate or not.

- This is the final step, so you’ll then be ready to click calculate and see how many dollars you’ll either pay or receive!

- NOTE: If you run a business, your tax return is a little different but all the information you could want and need is accessible via the ATO website.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.