At the risk of being called dull and boring, again let me remind you that the main game must be to find money and get it into income earning assets. At the same time, you must have a serious look at the disastrous debt situation you might be in, and then do something about it.

Let’s understand the nature of our problem.

How do we wind up in debt?

That’s easy — we want things our current income and savings can’t bankroll. Houses, cars, furniture and holidays are the key culprits, but some ambitious types do the debt-thing to start a business or buy shares.

Along with homebuyers, these latter groups from Never Never Land show us all the way. In the end, there is good debt and bad debt, and borrowing for an asset that appreciates (goes up in value) or generates income is good debt. Cars are famous for depreciating the minute you drive them out of the car yard. A car is a classic creator of bad debt. (Apologies to car salespeople.)

How can we make ourselves less prone to debt?

If you’re living a life that always ends up with a forever-rising debt-ridden bottom line, try doing the opposite. For the uninitiated, it’s called saving.

How do you become a saver?

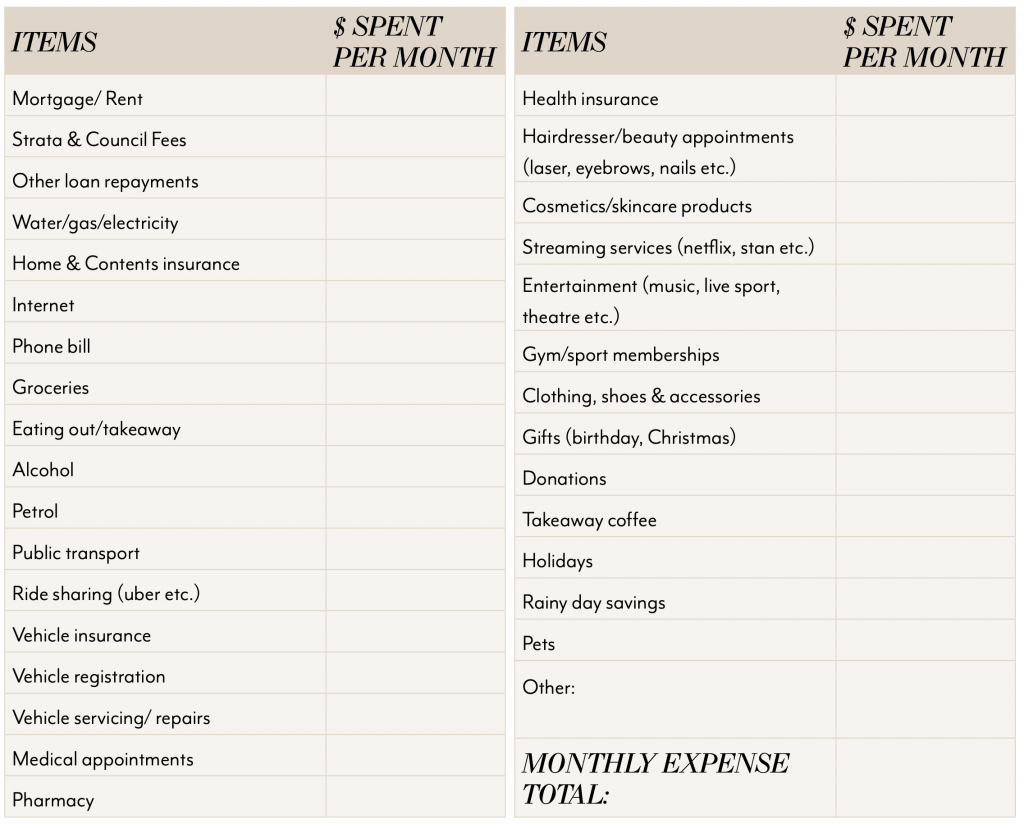

There are lots of boring recommendations — like stop spending, and you’ll instantly see savings. But the best starting point is to do a budget.

Do you come clean with yourself?

It’s the only way to reform your bad habits.

How do you do a budget?

Now for the scary bit…

- Put your weekly take home income here $ ………….. (b)

- Put your weekly expense total here $ …………….. (a)

- Deduct weekly income from expenses $ ………….. (c) Your weekly savings

Now, if you are game, take this weekly saving amount and multiply it by 52 to see what you are saving each year, (or you might be dis-saving if this amount is negative).

………….. (c) x 52 weeks = …………….. (Oh no!)

What this means and what you have to do

This exercise can be nearly as scary as standing on a set of scales after an overseas trip, or after Christmas day lunch. If it’s a big positive, you are sitting pretty in stage one of the ‘how to get rich’ stakes. If it’s a small positive, well, that’s a start. But if it’s a negative, you have a lot of work to do.

My tip is — GST your life

If I tell you to take $100 out of your pay each week, you may think: “Too hard!”

Wrong! Look at what you spend each week and ask yourself these questions:

- Can you cut your $200 supermarket bill to $180?

- Can you drink VB instead of Crown Lager?

- Can you go to a restaurant and not have dessert?

- Can you buy a 10% cheaper wine?

- Can you ask for a 10% discount for paying cash?

This is how savings happens. Simply, adopt a ‘get even strategy’ against all the businesses that overcharge you because your spending life is chaotic and not planned.

Here’s an example:

Do you pay $3 or $4 for a coffee? If you drink three a day, opting for the former saves you $900 a year, which translates into a $30,000 saving of interest on $100,000 home loan!

A surprising and helpful hint

Experts say that 30% of the bank fees paid we pay are avoidable. By some simple changes in behaviour and using tools provided by banks, customers could save a reasonable amount.

We can be our worst enemies because we don’t make an effort daily, which costs us dearly over a lifetime of dumb money practices.