We hear about the “wealth effect” a lot during property and share market booms. Here are 4 ways stock market investors can benefit from the property boom.

I attended two auctions, as a spectator, on the weekend. Both drew a large crowd, frenzied bidding and a few gasps as prices hurtled past the expected range.

The vendors were no doubt thrilled, but it was comments from onlookers – stickybeak neighbours like me – that stuck. I suspect many property owners who attended the auctions walked away feeling far wealthier.

We hear about the “wealth effect” a lot during property and share market booms. As asset prices rise, people are more inclined to spend their paper gains, or so the theory goes. That’s good for housing-related retailers such as JB Hi-Fi and Harvey Norman Holdings.

I’m concerned about higher inflation in the medium term (1-3 years) and the potential for interest rates to rise sooner than the market expects. But I can’t see anything derailing Australia’s property boom over the next 12 months, unless regulators step in again to curb lending.

Stocks that have strong tailwinds from the property boom appeal. But in many cases, the market has factored the boom into share prices. Property-related stocks are mostly fully valued.

The big banks are the safest way to play the property boom. They’ll benefit from fewer impaired loans than the market feared during COVID-19. Also, rising asset prices will underpin high business and consumer confidence, boosting credit demand.

Westpac remains my favoured bank stock, followed by ANZ Banking Group and National Australia Bank. The Commonwealth Bank is the standout, but pricey after its rally.

Here are four other ways for investors to benefit from the property boom. The ideas suit experienced investors who understand the benefits and risks of owning small- or mid-cap stocks.

- Luxury goods

Consider someone who owns a four-bedroom family home in an inner suburb of Sydney or Melbourne. The $2-million house might be worth $2.4 million in the next two years if Westpac’s predictions price growth in that period hold.

Now $400,000 wealthier on paper, some homeowners (not all, of course), will bring forward house renovations, buy a new car, take a holiday (COVID-19 permitting) or treat themselves with other goods and services. That’s great for luxury-goods providers.

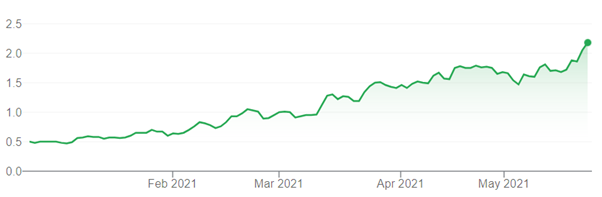

I wrote favourably about Cettire in this Report in mid-February at 86 cents a share INSERT LINK PLEASE JON Shares in the luxury-goods platform hit $2.26 this week after announcing a partnership with global buy-now, pay-later provider Klarna.

Cettire had a low profile before its soaring gains last week. The company listed on ASX in December after seeking $65 million at 50 cents a share.

To recap, Cettire sells more than 160,000 luxury goods through its site. That includes apparel, shoes and bags from Gucci, Prada, Burberry, Versace and other prominent brands. Cettire says it has one of the world’s largest ranges of luxury goods with 1,300 brands on its platform.

I wrote in February, “… there’s a lot to like about Cettire’s emerging position in online luxury-goods retailing”. Nothing in my view has changed.

Cettire’s share-price gains might be slower from here, and a pause or pullback would not surprise given the extent of its rally. But the luxury goods market – and online platforms that sell high-end products – have long-term growth prospects.

Chart 1: Cettire (CTT)

Source: ASX

- Auto stocks

The turnaround in auto-related stocks over the past 12 months has been phenomenal. It wasn’t so long ago that the market fretted over falling vehicle sales and profits. Now, the market can’t get enough of auto stocks that benefit from the wealth effect of higher house prices.

Newly listed auto retailer, Peter Warren Automotive, this week upgraded its prospectus profit forecast – less than a month after listing, such is the momentum in vehicle sales.

I wrote favourably about two small-cap auto stocks in this Report in November:

Autosports Group and Motorcycle Holdings.

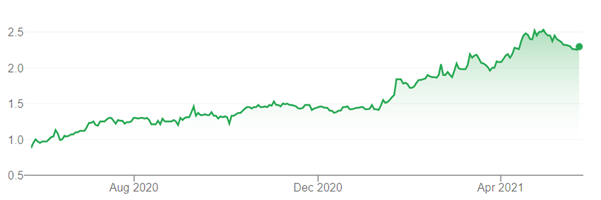

Autosports has rallied from $1.41 in November 2020 to $2.48. Motorcycle Holdings is up from $2.40 in November 2020 to $3.09, and its price looks to have broken out of an accumulation (sideways pattern).

Autosports owns more than 40 new or used luxury-car dealerships. Motorcyle Holdings is Australia’s largest motorcycle dealership with around 30 outlets. Both benefit from wealthier homeowners putting a BMW or Harley Davidson in the garage when their home’s value rises.

I still like both stocks. Autosports can continue to grow organically by acquiring dealerships in a fragmented luxury-car retailing market. The business is well run, has scope to cross-sell more products and services to customers, and still looks reasonably priced.

Motorcycle Holdings probably has the most upside of the two stocks, given it has lagged a little in the recovery and is still down on previous highs around $5. However, Motorcycle Holdings has a higher risk profile because it relies more on a single brand: Harley Davidson.

Chart 2: Autosports Group (ASG)

Source: ASX

- Storage A-REITs

Rising renovations activity is good for companies such as Beacon Lighting Group and furniture company Nick Scali, two small-cap retail favourites of mine in the past two years (Nick Scali has been one of my top small-cap ideas for years).

It’s also good for plumbing stocks, such as GWA Group, that are usually better later in the renovations cycle when new bathrooms and kitchens are installed.

Less considered is the impact of higher renovations activity on self-storage Australian Real Estate Investment Trusts (A-REITs). When homeowners embark on major renovations, they often have to move out of their house and rent for a while.

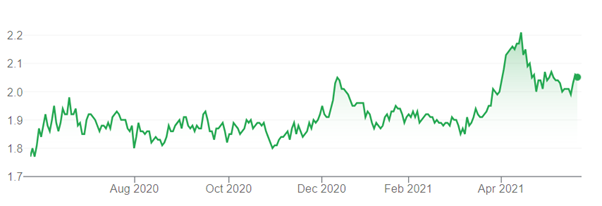

That benefits self-storage A-REITs, such as National Storage REIT and Abacus Property Group. Self-storage is a fascinating part of the market in niche A-REITs. Markets such as the United States have large self-storage operators; our market is far more fragmented.

National Storage can continue to grow by acquiring privately owned self-storage facilities. The long-term trend of more people renting and living in smaller apartments – and thus having to rent extra storage space – bodes well for National Storage and Abacus.

National Storage is not cheap and operating conditions will become more challenging given the A-REIT’s already high occupancy rates. It will need to increase rental rates at some point, which could be hard if consumers, struggling from low or no wage increases, resist.

But I doubt the market has fully factored in the potential for National Storage customers to hold their storage for longer, due to higher renovations activity and more people renting for longer (and needing extra space). I suspect National Storage has a little more pricing power than the market has factored in, courtesy of the property boom’s impact on renovations activity.

Chart 3: National Storage REIT (NSR)

Source: ASX

- Broadband installation

What do new homes and apartments need more than anything else? Broadband. That’s right, forget about electricity, gas and water … a wi-fi connection is far more important these days!

Yes, I jest. But companies that install broadband in new housing and apartment developments are superably leveraged to the housing boom. The most interesting of them is Uniti Group.

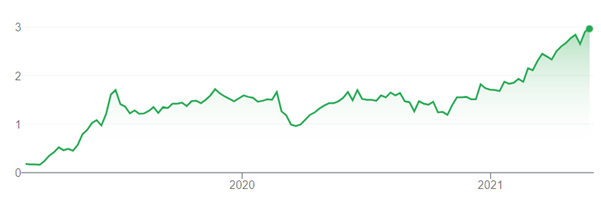

Uniti installs “last mile” network infrastructure in greenfield housing developments. The well-run company last year merged with Opticomm, a provider of broadband fibre in apartments. It was an ideal merger on paper.

Uniti has soared from a 52-week low of $1.16 to $3. I am normally wary of stocks after such big gains, but I’ll make an exception for Uniti, with the caveat that prospective investors should be prepared to hold the stock for at least three years as it could be volatile.

My favourable view on Uniti is based on three factors. First, Uniti will benefit from continued growth in greenfield land and apartment development, and thus rising demand for broadband installation. Second, it can take some market share from NBN. Third, the company has a large, growing order book of contracts that will underpin earnings for some time.

Prospective investors might wait for a pullback in Uniti, and a better entry point. The stock won’t stay down for long if the price corrects: some small-cap fund managers I know rate Uniti highly and like the prospects for broadband installation during a property boom.

Chart 4: Uniti Group (UWL)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 26 May 2021.